-

web.groovymark@gmail.com

- November 22, 2024

250 WGU D105 OA Questions and Answers to Pass in Just 7 Days – Your Study Guide 📖

Are you ready to tackle the WGU D105 Objective Assessments (OAs) for Intermediate Accounting III? Look no further! This guide will act as a reference source for all the material and advice that is needed in order to succeed in this particular course. Learning how to approach your academic books properly and how to tackle different types of assessments might prove that passing the D105 course, as well as all of its tests, is quite doable.

100%

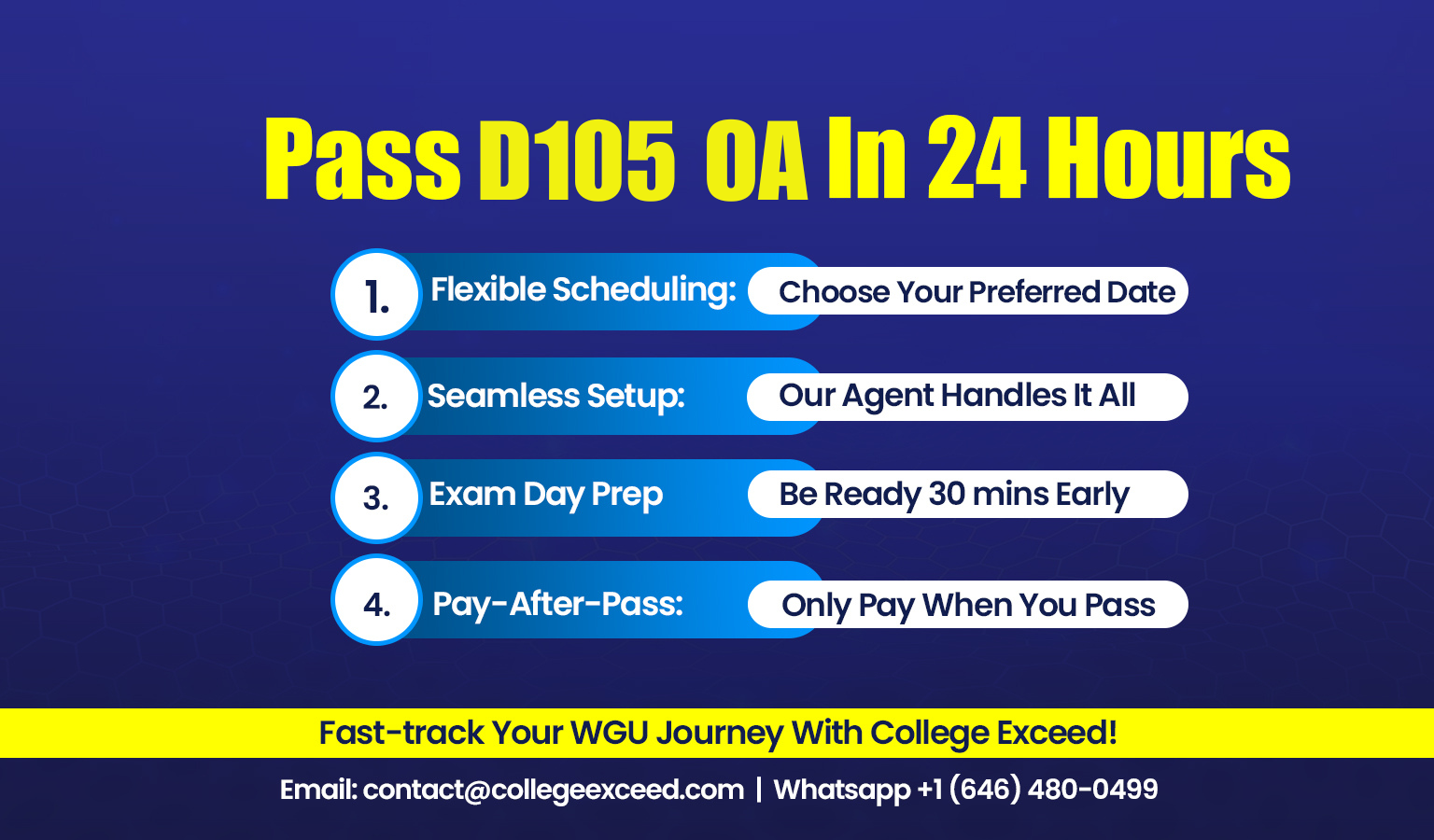

Pass the OA exams with our premium exam support

Why Prepare with Our D105 Resources? 👨🏻🏫

Intermediate Accounting III of WGU D105 is a crucial course in your accounting line as you will learn analytical details that are the foundation of accounting and reporting. The multiple choice questions in the Objective Assessments (OAs) will cover important areas such as investments, revenue recognition, income taxes, leases, pensions, and changes in accounting estimates. In order to achieve that goal you have set, you require a good study plan/road map and that’s where our materials come in handy.

Our resources are specifically tailored to help you:

- Increase your knowledge of the main principles of accounting.

- Get to know the type of questions you will be expected to answer concerning the OA.

- Try and be as confident as you can so that you can be strong when undertaking the above assessments.

What You'll Find in Our WGU D105 Study Materials🔎

- Realistic Practice Questions: Our question bank includes practice questions that closely resemble those found in the actual Objective Assessments. These questions incorporate all topics of the D105 course, that is, investments, revenue recognition, accounting for income taxes, leases, etc.

- Detailed Explanations: In addition to each question, a rationale of how to solve it is highlighted to provide you with solutions to the questions as well. This is very important in creating a good base for conceptual learning of the course topics.

- Comprehensive Coverage: All our materials encompass the D105 curriculum hence guaranteeing the student that they are covering all important subjects.

- Exam Readiness: It is necessary to take the time to learn how the assessments are going to be structured so that you are not caught out when facing the OA and it is important to successfully work on time management.

How to Use Our WGU D105 Resources for Maximum Success🎓

- Start Early: Begin your preparation as soon as possible. Early practice will help you identify areas that need further review, allowing you to focus on your weaknesses before the OA.

- Review Regularly: Revisit questions and explanations multiple times. This also helps to reinforce your learning as well as enhance your memory of important knowledge that you have acquired.

- Simulate Exam Conditions: When you are able to go through the content use full-length practice exams to enable you to prepare under real test situations. This will assist you in time management so that you are able to get used to the format of the OA.

- Analyze Your Performance: When going through your performance, it’s advisable to go through the answers and see where you made mistakes, and how they affected your results. This will guarantee you have worked on your areas of weakness, and at the same time is a working point of your strength.

View WGU D105 OA Questions and Answers Here!📝

Intermediate Accounting III WGU D105 OA Practice Exam Questions #01

Prepare effectively with these curated question sets.

Intermediate Accounting III WGU D105 OA Practice Exam Questions #02

Test your knowledge with a new set of questions.

Intermediate Accounting III WGU D105 OA Practice Exam Questions #03

Challenge yourself with advanced questions.

Intermediate Accounting III WGU D105 OA Practice Exam Questions #04

Boost your preparation with these practice questions.

Intermediate Accounting III WGU D105 OA Practice Exam Questions #05

Finalize your revision with these comprehensive set.

Dive Deeper into Intermediate Accounting III WGU D105🔑

Understanding the Core of WGU D105

The WGU D105 – Intermediate Accounting III course will help students enhance their knowledge of advanced accounting. Continuing in the same sequence of development of concepts from past courses this module presents more advanced issues like investments, income taxes, pensions, leases, and statements of cash flows. It also addresses the Full Disclosure Principle and the nuances of error correction in financial reporting.

By the time, you are learning through D105, all these skills will have been imparted to enable you to deal with all the complications that are found in financial reporting and analysis. The course will also show you how to use these principles in real-life situations and this is very useful for anyone who is contracting to become a professional accountant or any financial-based career.

What Makes WGU D105 Unique?

One of the most appealing aspects of the course, WGU D105 is its applicative orientation. The course is also not purely theoretical, it also allows you to really engage and apply a lot of the accounting principles you are taught to the real world. Such an opportunity for practical training will let you be ready to deal with the difficult aspects of financial reporting, which you could face in your job.

Furthermore, WGU D105 talks about the ethical roles of accountants especially in issues of revenue recognition, other revenue, and incorporating errors and tax reporting. The course throws a test to you and makes you come up with a critical analysis of how accounting information affects decision-making processes and the direction of organizations.

Key Learning Outcomes:

By the end of WGU D105, you will have mastered several critical accounting competencies, including:

- Revenue Recognition: Understand when and how to recognize revenue under various accounting methods.

- Investments: Learn how to classify, value, and recognize investments for accounting purposes.

- Accounting for Income Taxes: Get an understanding of how deferred tax assets and liabilities are dealt with together with inter-period tax allocation and calculation of the tax expense.

- Accounting for Leases: Learn about the lease classification, measurement, and assessment of the effect of leases on an organization.

- Pensions and Post-Retirement Benefits: Develop a solid understanding of pension accounting, including expense components, funded status, and disclosures.

- Statement of Cash Flows: Master the preparation and analysis of cash flow statements, paying special attention to operating, investing, and financing activities.

- Full Disclosure in Financial Reporting: Gain a sufficient understanding of various pension expense components, pension liability or assets, and pension disclosures.

Prepare for WGU D105 with Confidence 👍🏻

The overall organization is the approach to WGU D105, and the right study material will prepare you to do well on both the Objective Assessments (OAs). All the important areas of Accounting are catered to in the detailed study materials of the section: investments and income taxes, leases, and pensions to name a few, helping you prepare well for the OAs.

Objective-type practice questions akin to those on the actual exam, and focused summaries to help you better comprehend challenging material, allow you to approach the course material with confidence. It is recommended to use the different study materials in order not only to solve the assessment but also to refresh and strengthen your knowledge of the advanced accounting concepts that might be valuable in your future career.

Avoid risking your grades by not preparing adequately for WGU D105; make use of our resources to prepare adequately. Not only do you have resources for reviewing the course material by key topics, but it can help you with the practice questions and much more.

Check out our WGU D105 study questions and resources now and begin building your knowledge of Intermediate Accounting III right away!